Learn how to optimize cash inflow, minimize outflows, and achieve a healthy balance for your business.

Strategic Advisor

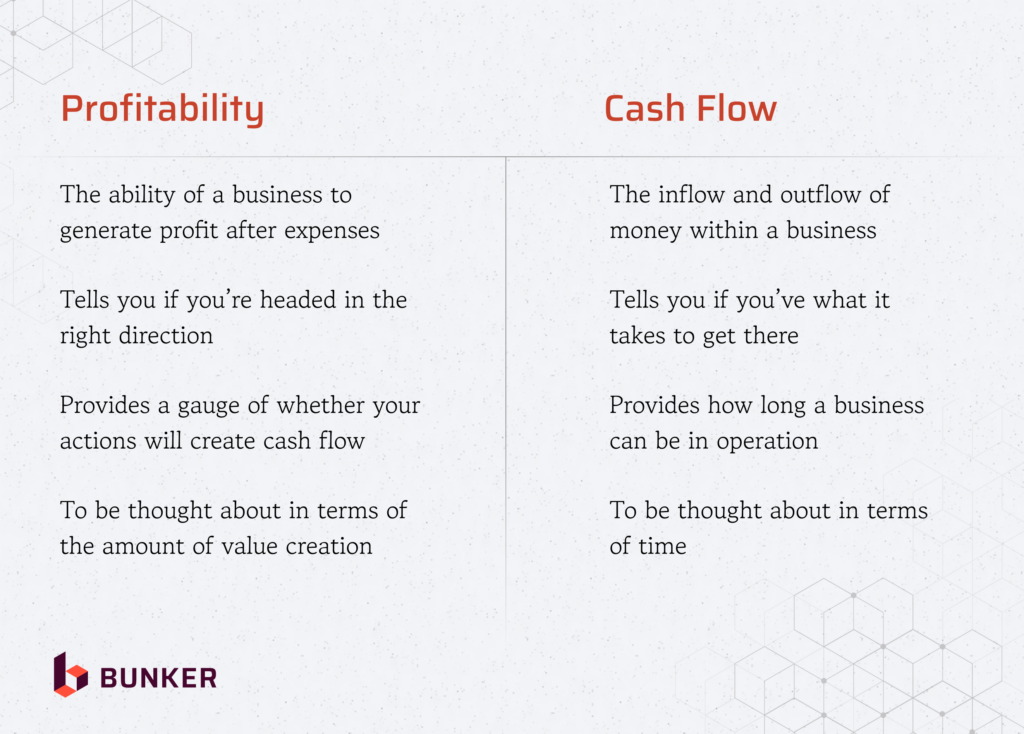

Cash is the lifeblood of any business. Often, the business world focuses on the Income Statement, namely, revenue, EBITDA and net profits. No doubt, these financial measures are critical to understanding business performance. However, increasing profits are not always an indication of increasing cash balances. Understanding the difference between cashflow and profit is an essential skill for CEOs and CFOs to make better decisions.

In this article, we will answer some of the most common questions you may have about cashflow, including what is the difference between profit versus cashflow, what are the different types of cashflow, and how enterprises of all kinds can improve their cashflow management.

Cash Flow, as described by Harvard Business School, is “the net balance of cash moving into and out of a business at a specific point in time.”

Business activities comprise positive and negative cash flow components.

Positive cash flow is any action or transaction that increases a business’ cash balance. Negative cash flow is any action or transaction that reduces a business’ cash balance. For example, if a sandwich shop were to sell a sandwich for $8, the company would record a positive cash flow of $8 as well as negative cash flows for the costs of making the sandwich, such as sandwich ingredients, labor costs of employees, shop rental, utilities, etc. If the company’s positive cash flows exceed negative cash flows, the company’s bank balance will increase.

However, even keeping this in mind, it is important to remember how cash flow and profit are categorically different.

Cash flow and income statement performance diverges when timing of recording transactions differ. In the sandwich shop example, the company records revenue and cash receipts of $8 at the time of sale. However, the sandwich shop may buy the sandwich meat on 30-day credit terms. It will record the expense at the time it receives the bill for the sandwich meat, but only show a negative cash flow when the company actually pays the invoice 30 days later.

Let’s consider the sandwich meat seller. This company can record the sale of the meat to sandwich shop but has not yet collected payment. Hence, it will likely record that sale as revenue, which will have a positive impact on its total profit. However, if the sale has not formally been paid, then there won’t actually be any cash flowing into the business, meaning the cash flow will not yet be recorded.

The statement of cash flow contains three distinct types of cash flow: operating cash flow, investing cash flow, and financing cash flow.

Operating cash flow refers to all cash flow that can be directly attributed to the day-to-day operations. Investing cash flow generally refers to the company’s investment activities, most commonly purchase or sale of fixed assets or other companies. Financing cash flow generally refers to any activity used to finance the business, such as raising debt or equity and repayment of debts.

It is important to keep in mind that cash flows can be both positive and negative. The difference between positive cash flow and negative cash flow is known as net cash flow.

Positive cash flows occur whenever new money comes into the business. This often means generating additional sales but even things such as taking out an additional loan can qualify as a “positive” cash flow. Generating net positive cash flows is essential for businesses to have the cash needed to continue their operations.

Negative cash flows occur whenever cash is flowing out of the business, such as paying operating expenses (rent, utilities, materials, etc.) or paying down existing debt. If a business continues to have net negative cash flows, eventually, it will run out of cash which may result in insolvency.

Imagine you run a small retail business. At the beginning of the month, you have $5,000 in your business bank account. Throughout the month, the following cash flow events occur:

At the end of the month, you tally up your cash flow:

Starting Cash Balance: $5,000

Total Cash Inflow: $8,000

Total Cash Outflow: $3,000 + $1,500 + $800 + $300 + $200 = $5,800

Ending Cash Balance: Starting Cash Balance + Total Cash Inflow – Total Cash Outflow

$5,000 + $8,000 – $5,800 = $7,200

In this example, your cash flow for the month is positive, with an ending cash balance of $7,200.

This means your business generated more cash (through sales and other inflows) than it spent on expenses and costs (outflows) during the month.

Positive cash flow is essential for a healthy business, as it allows you to cover expenses, invest in growth, and be prepared for any unexpected financial challenges.

However, if your cash outflow exceeds your cash inflow, you would have a negative cash flow, which can lead to financial difficulties and potential cash flow problems.

There are short-term solutions to managing cash flow deficits, such as borrowing money. However, the accumulation of debt increases liabilities on the balance sheet, i.e., future financial obligations.

Failure to develop a sustainable pricing model, challenges balancing accounts payable and accounts receivable, insufficient financial forecasting practices, and many more failure points are common drivers of cash flow management challenges.

Ultimately, the need to manage cash flow is something that no company can afford to ignore. Developing a robust, active, and forward-looking cash flow management strategy will make it much easier to stay solvent and achieve other long-term financial goals.

There is no denying that there is a direct link between working capital and cash flow. By converting current illiquid assets into liquid assets, you can directly improve the cash flow situation.

With Bunker’s FP&A software, you will be able to get an unparalleled view of your company’s finances, including your cash flow. Make confident decisions with speed and hold your team accountable with reliable data. It’s the tool that delivers impact through surgical cost savings, superior cash conversion cycles and intelligent, dynamic budgeting.

Being able to discover a chance to reduce costs–wherever that might be–will further improve the cash flow operation.

A financial analytics software like Bunker can step in here and help you process rows of data from the General Ledger to give you complete financial visibility in minutes. This can help you identify areas or departments where you can cut down costs, such as – marketing spend or vendor costs.

One of the best methods to decrease the amount of cash flowing out of a business is to address all relevant vendors.

These vendors might be much more flexible than you assumed.

With Bunker, you can get detailed vendor & transaction level drilldowns within a customisable vendor dashboard.

With vendor-level visibility in hand, you can identify specific vendors through COGS line items for negotiation opportunities, like favourable bulk driven pricing.

By upping the sales figures, the business will appear more “cash flow positive”, which will spark a windfall of additional benefits.

Increasing sales and other revenue streams will improve the cash flow situation, so long as the company has a pricing model where marginal revenues are greater than marginal expenses (otherwise, net cash flows will be negative). Of course, doing so is often easier said than done—in some cases, companies will need to get creative, such as diversifying their sources of revenue.

Knowing the best ways to manage cash flow is not always easy. This is especially the case for early-stage companies whose financial situation is likely dramatically changing with each passing day. Sometimes the best solutions to addressing cash flow issues are hidden deep in the numbers, which can be extremely difficult and tedious for managers to fully analyse on their own.

According to a Thomson Reuters survey of APAC finance executives, more than 60% said that the time taken to complete statutory reporting took upwards of two weeks. These inefficiencies should be a priority for businesses focused on streamlining their financial processes.

As data becomes an increasingly valuable asset, the need for automated financial planning and accounting software, such as Bunker, continues to grow. Through automation, organisations can efficiently—and effectively—analyse thousands of lines of financial information, allowing them to generate deeper insights and identify their best moves forward.

There are countless cash flow insights that can potentially be drawn from this analysis. For example, a business might suddenly discover that they have a suboptimal pricing structure that needs to be adjusted. They might also realise that their payment periods differ significantly from the industry norm, meaning there is a need to change the ways they collect accounts receivable from clients and fullfill accounts payable to their vendors.

With automation, the amount of time it takes to make these sorts of discoveries is significantly reduced. As the company continues to scale up over time, the need for having automated financial planning and accounting software becomes even more important.

Improving cash flow management strategies is one of the most effective ways for businesses to establish a competitive edge. That is why it is so important for young companies to ensure the right tools and resources are in place—and are being fully utilised—as early on in the business cycle as they possibly can.

Bunker is currently offering early access to select companies. If you’re keen, register your interest.