A senior finance leader reflects on lessons learned in Corporate Financial Planning and Analysis, highlighting opportunities for improvement.

Strategic Advisor

The following piece was contributed by Adam Mokhtee, CFA, strategic advisor to Bunker. Adam shares more about his experience with financial planning and analysis and being a leader in the turnaround efforts at Yellow Corporation.

August 2023 marked the end of a 16-year fight for survival. Yellow Corporation filed for Chapter 11 Bankruptcy. Bank-rupt-cy…three of the most feared syllables in business.

Started in 1924, Yellow grew to be one of the largest less-than-truckload carriers in North America sporting nearly USD 10 billion in annual revenue. At its peak, Yellow was #249 on the Fortune 500 list and had 400+ trucking terminals, 15k+ trucks, 40k+ trailers, 30k+ employees, and 100k+ shipments per day – all globally.

Troubles began in 2007 with the Great Recession as shipping volumes evaporated. By 2008, Yellow was on the precipice of bankruptcy.

I joined Yellow’s internal turnaround team in 2009 in what would become a career-defining moment for me. For the next 8 years, I was best described as the “roving linebacker” (American football reference), sent to tackle any restructuring effort – debt restructuring, credit amendments, equipment financing, M&A, strategic investments, etc.

Before Yellow, I had served as the Director of Treasury Finance & Capital Markets Risk Management at Sony, and as Corporate Strategy Manager at T-Mobile, one of the largest telcos in the US.

Among the several different positions I held during my nearly decade-long tenure at Yellow, I served as Head of Corporate Financial Planning and Analysis (FP&A).

Financial reporting was the heart of my department’s function, and our key stakeholders were management, the Board, equity investors, lenders, employee unions, and pension funds.

We laboriously collected data from departments including but not limited to finance, corporate accounting, treasury, tax, risk management, and several operations departments.

We generally had only 4-5 working days to complete the monthly financial reporting package for a USD 5 billion company.

Data traversed through many Excel files and ultimately transferred to PowerPoint. The financial planning and analysis process faced a high risk of errors often requiring multiple iterations to deliver a zero-defect product to the CFO before being disseminated to external stakeholders.

Back then, ‘data engineering’ was a foreign concept to finance teams and surprisingly remains the case for the majority of companies even now in 2023.

Few have a deep understanding of the nuances of structured vs. unstructured data, pipes and databases, APIs, ETL scripts, etc.

On the other hand, data engineers often do not have the background to understand the nuances of finance and accounting including double-entry accounting, the general ledger manual journals, bills, invoices, payment terms, purchase orders, a chart of accounts, etc.

So, how did we perform FP&A in 5 days for a 5 billion dollar company?

We put in 100+ hour weeks during peak periods, navigating clunky accounting systems, which seem to have remained clunky and manually spot-checking the general ledger.

We also managed multiple, massive spreadsheets, while also auditing manual errors in formulas.

When I first met the Bunker team and learned that they were trying to ingest general ledger data, I was extremely intrigued because I had never in my nearly 20-year career come across a business intelligence tool or software that integrated with and understood the nuances of ingesting the general ledger.

After being impressed by the deep, self-taught accounting domain knowledge that the engineers amassed at Bunker, I decided to join on as an advisor to help build the tool I wished I’d had back during my time at Yellow.

One of the most difficult things about that process was not having a tool that could tread through transactions with precision. Mining a general ledger with thousands of rows of transactions for actionable insights needed a data science approach, not more reports.

Bunker has created just such a tool. More critically, is the price point of the tool, speed of implementation, and ease of use to operationalize. All three factors are hurdles that prevent the adoption of automated tools in corporate finance.

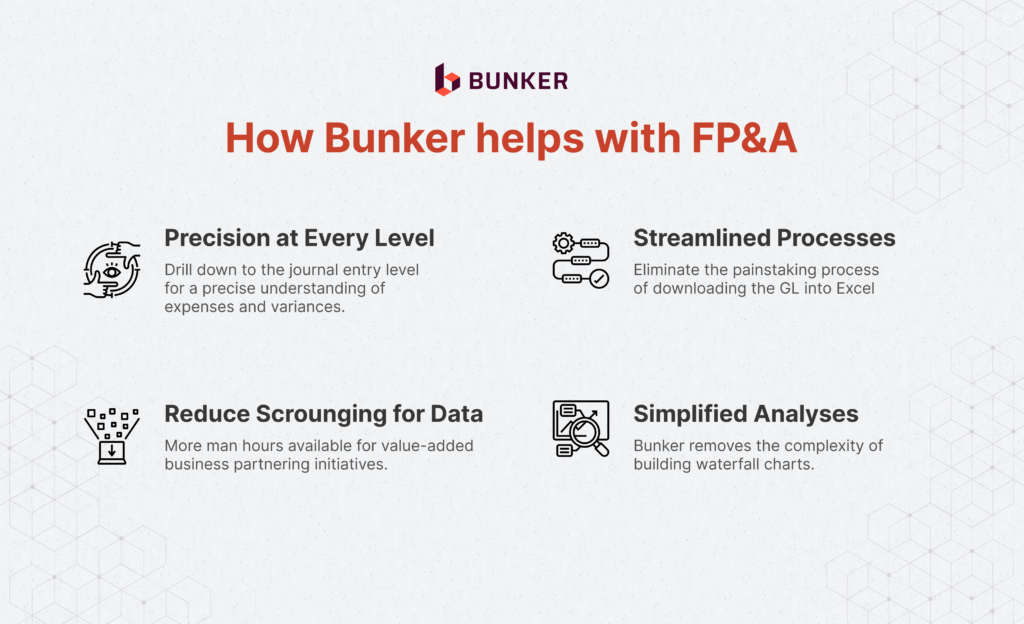

If I had Bunker back then, my team would have benefitted in the following ways:

Moreover, with Bunker’s expense/vendor distribution and share of wallet views, my team would have had the heavy artillery required to drive cost transformations needed at a company facing a prolonged liquidity crisis.

Many finance teams today are still grappling with painful cost-cutting initiatives given a complicated macroeconomic backdrop.

Luckily, Bunker can provide these teams with the surgical capabilities needed to focus more on strategy and execution, and less on chasing and auditing data.

Bunker is a financial analytics platform that drives cost-savings & optimised cashflow by turning thousands of overlooked rows in the general ledger into tactical business decisions through an intuitive dashboard and monthly reports.

Bunker is currently offering early access to select companies. If you’re keen, register your interest.